amazon flex take out taxes

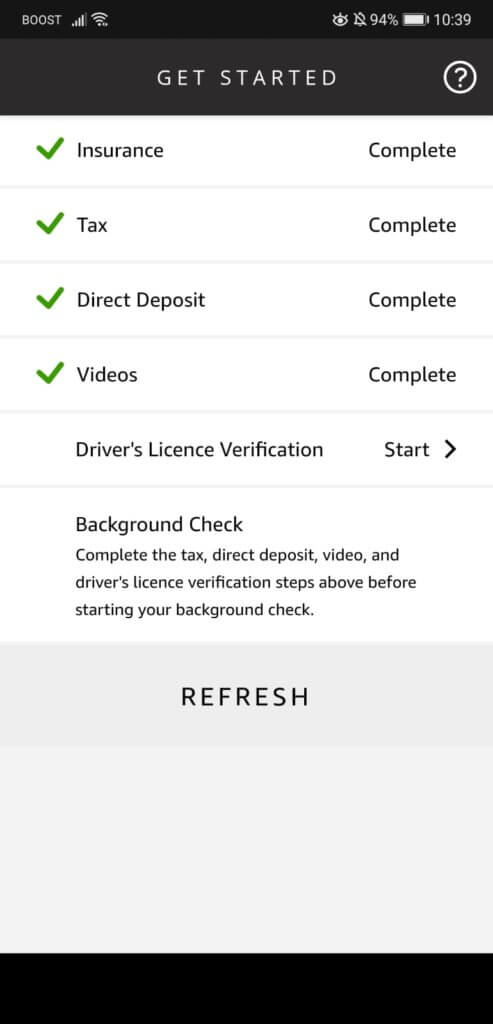

Amazon Flex drivers are self-employed independent contractors in 2022. Your 1099-NEC isnt the only tax form youll use to file.

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Amazon Flex Reviews Online.

. If you have records of oil changes and other car maintenance maybe you can figure out the average miles per. With Amazon Flex you work only when you want to. But instead of it taking you four hours to make all of your deliveries you managed to make them in three hours.

Class 2 National Insurance is paid as a set weekly amount when your. If you have a W-2 job and do Amazon Flex for extra money you can increase your withholding at your main job instead of paying quarterly taxes. Get to the Fulfillment Center Early.

Unfortunately youll still have to report your income to the IRS even without a 1099. Report Inappropriate Content. Your mileage comes right out of income on your 1099 before you take any deductions.

This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. We know how valuable your time is. Therefore you are depot based and your journey from home to depot is ordinary commuting and cannot be claimed at all as business mileage whether you are self employed.

Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self. Income tax starts at 20 on all your income not just from amazon over 12500 and 40 over 50000. Whatever drives you get closer to your goals with Amazon Flex.

If you still cannot log into the Amazon Flex app. Its almost time to file your taxes. Knowing your tax write offs can be a good way to keep that income in.

Sign out of the Amazon Flex app. Adjust your work not your life. Pickups from local stores in blocks of 2 to 4 hours.

It has 25 stars. You are required to provide. You can make closer to 25 per hour by using a larger car which makes you eligible to deliver more packagesAnother option is to claim blocks during busy times which are marked in the.

Driving for Amazon flex can be a good way to earn supplemental income. Youre suppose to pay quarterly which I will now dropping 27k nearly all at. Businesses such as partnerships S corporations or LLCs that are taxed as.

Understand that this has nothing to do with whether you take the standard deduction. Amazon Flex quartly tax payments. Tap Forgot password and follow the instructions to receive assistance.

I did flex full time in 2017 made about 30k and after deductions Ill owe around 27k. Write Your Gas and Repairs Off as a Business Expense. Select Sign in with Amazon.

Unfortunately not everyone has had a wonderful experience with Amazon Flex and there are a fair amount of negative reviews. If youre an Amazon seller living in the US then youre probably aware that tax time is coming up. 12 tax write offs for Amazon Flex drivers.

This is a 1099 position and Amazon will not take out or withhold taxes for you. Take Advantage of Reserve Shifts. Only available in limited areas these deliveries start near your current location and last from 15.

If you dont have other tax withholding that covers your tax liability you will need to make quarterly tax payments. Drive a Fuel-Efficient Vehicle. In this position you are responsible for calculating reporting and paying your taxes in accordance with IRS regulations.

Maybe you guess that your average is so many miles per day. As an independent contractor you will use the information on form 1099 from Amazon Flex to complete Schedule C and Schedule SE which in turn are needed to complete. Amazon Flex does not take out taxes.

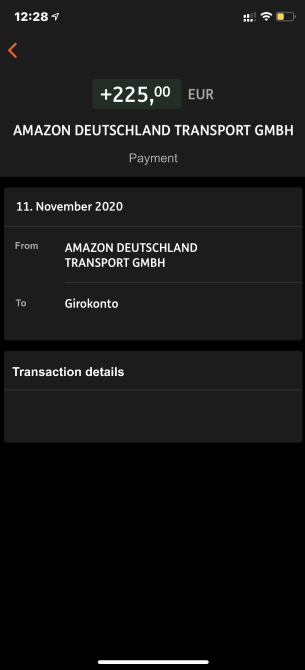

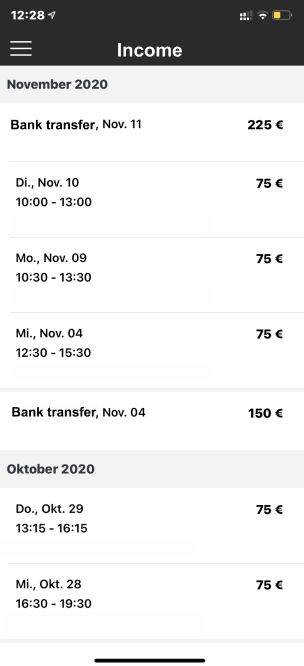

Fill out your Schedule C. And Amazon pays you 25 an hour so 100 for the whole block. Amazon Flex pays out earnings on a weekly basis for base pay and tips for the previous 7 days on every Wednesday.

To make sure you do this right just look through your bank statements and add up your direct deposits from Amazon Flex.

Get Paid To Drive Without Picking Up Strangers Amazon Flex Pays 15 An Hour And Up Side Gigs Pr Newswire Make Quick Money Online

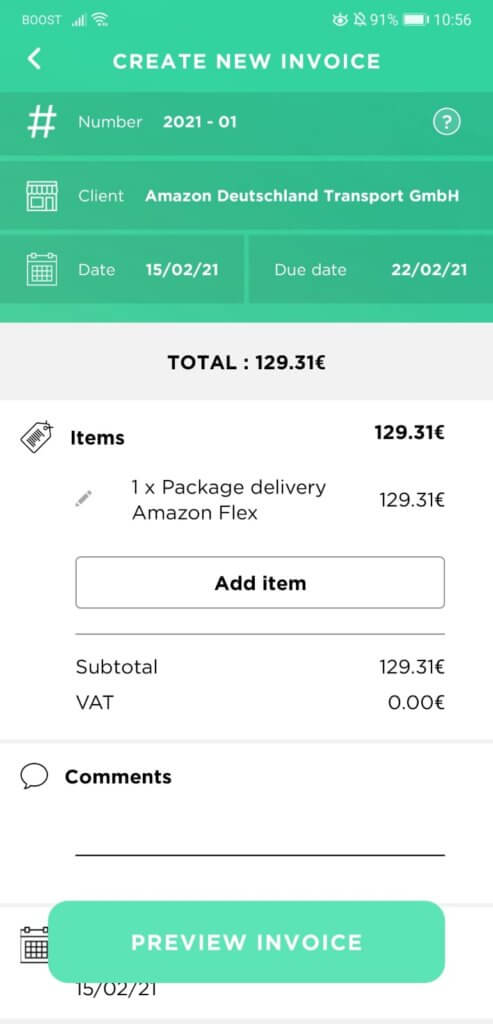

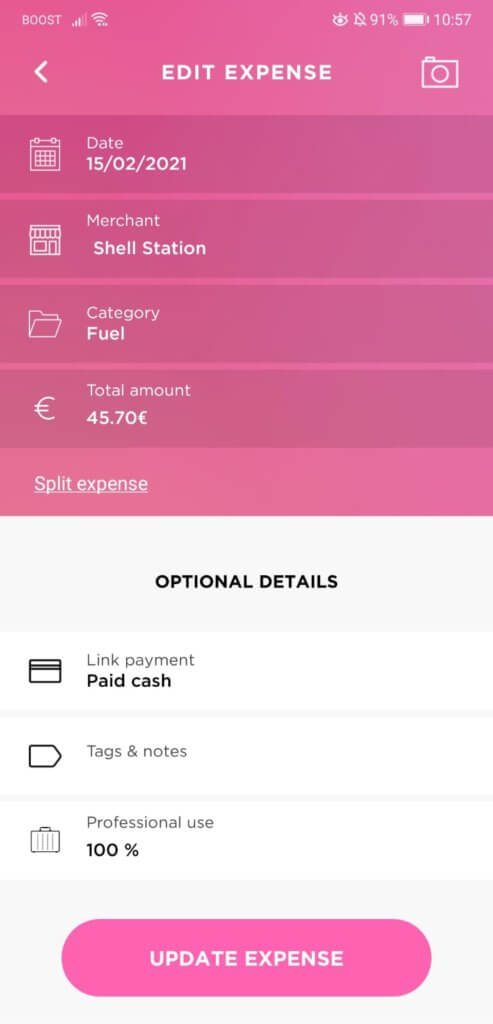

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Do Taxes For Amazon Flex Youtube

Amazon Sales Tax Accounting Tips For Amazon Sellers

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Amazon Flex 1099 Taxes The Easy Way

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

19 Tax Write Offs For Social Media Influencers In 2021 Tax Write Offs Office Necessities Creative Apps

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Flex Filing Your Taxes Youtube

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tracking App Tax Deductions Mileage